Taxes are one of your largest business and personal expenses.

I see way too many successful eCommerce businesses leaving thousands on the table every single year.

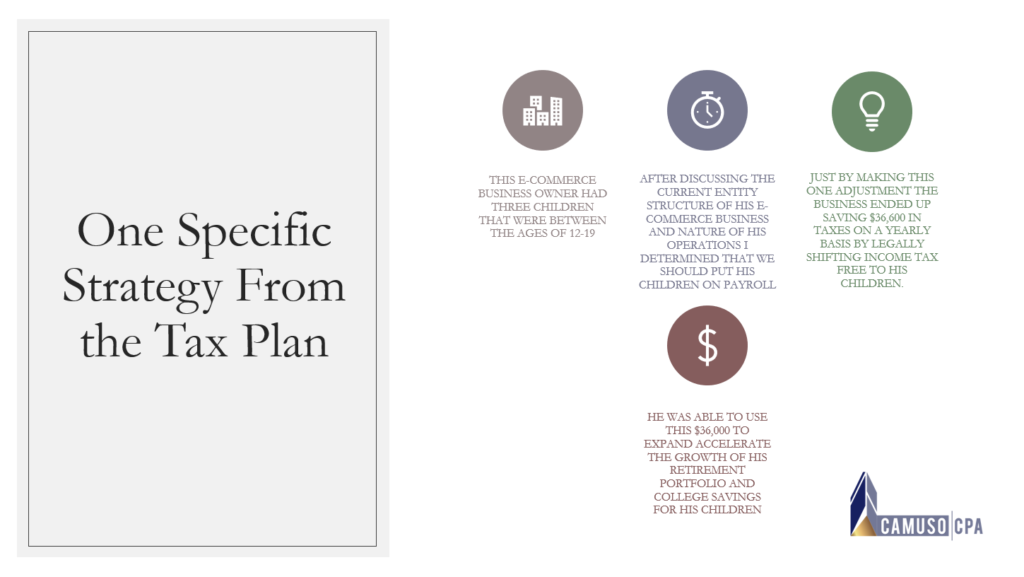

Like one client we recently worked with.

One specific income shifting strategy outlined below from the Tax Plan that we delivered to this client produced a yearly tax savings of $36,600.

Strategies that put thousands of dollars back into your eCommerce business.

Schedule a one-on-one consultation.

Tax planning is a system that is a structured by a proven process to assess your company and the tax code to pay the least amount of taxes as legally possible.

This is a separate process from tax preparation which is just focused on accurately and timely filing your taxes.

When I work with clients to create and implement a tax strategy, the result is legally reducing their taxes.

But this process includes several steps that actually help to reduce audit risk at the same time in order to protect your bottom-line.

👇 I recorded a video going over this below

Do you want us to help you with the tax planning process?

We cover the following aspects of your business and more during the tax planning process:

✔️ Legal Entity Structure

✔️ Accounting Method Optimization

✔️ Sales Tax and Other Compliance Assessments

✔️Deductions

✔️ Retirement

✔️ Insurance

✔️ Legal Tax Loopholes

✔️ Recent regulatory change

✔️ Niche specific strategies

✔️ Advanced planning strategies

Strategies that put thousands of dollars back into your eCommerce business.