Each week I have strategy sessions with eCommerce business owners, and all too often discover that they are leaving thousands on the table.

Every single year.

When you are competing as an eCommerce business you cannot leave any opportunity on the table.

You are competing in a highly competitive marketplace known for low margins, high competition and a rapidly developing business landscape.

You need every edge you can get to ensure your success over your competitors and to gain market share.

These overlooked opportunities represent funds you can use to grow your business.

More importantly, these are funds that your competitors may be using to grow their business if they have properly designed and implemented a tax plan.

Do you want help with the tax planning process?

Schedule a one-on-one consultation.

Any serious business needs a properly designed and implemented tax plan.

There are many who miss the opportunity to take advantage of the tax benefits the government has in place.

These tax benefits make it possible to legally reduce your taxes to accelerate the growth of your wealth.

I recently delivered a tax plan to an eCommerce business owner.

After we implement the tax strategies, we outlined in our tax plan, the business will save $46,700 on taxes.

EVERY YEAR.

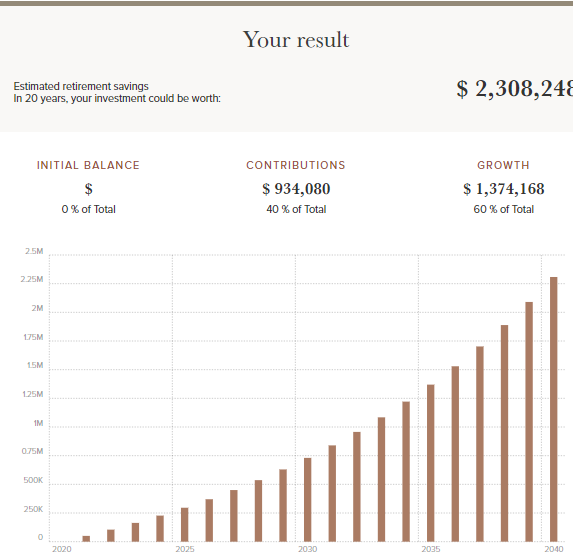

That yearly savings reinvested back into the business at only an 8% return will yield $2,308,248 over the next 20 years.

Do you want help with the tax planning process?

Schedule a one-on-one consultation.

Without additional sales, products, or marketing campaigns we were able to add over $2 Million to this business’s bottom-line.

If we placed this business in competition with itself pre-tax plan and post-tax plan, the post-tax plan business would have an extra $2,308,248 to grow their marketing, sales, products and overall company.

Which business would be more successful if competing in the same market vertical?

Do not give your competition the edge they need to take your market share by neglecting to proactively plan for taxes.

Do you want us to help you with the tax planning process?

Do you want help with the tax planning process?

Schedule a one-on-one consultation.

👇 I recorded a video going over this below

We cover the following aspects of your business and more during the tax planning process:

✔️ Legal Entity Structure

✔️ Accounting Method Optimization

✔️ Sales Tax and Other Compliance Assessments

✔️Deductions

✔️ Retirement

✔️ Insurance

✔️ Legal Tax Loopholes

✔️ Recent regulatory change

✔️ Niche specific strategies

✔️ Advanced planning strategies

Do you want us to help you with the tax planning process?

Schedule a one-on-one consultation at the link below: