Most people go to the doctor and dentist, at least annually, for a checkup regardless of their health status.

This is part of a long-term strategy for a long-term wellness and health.

The same routine should be in place with your CPA regarding your tax planning and finances.

This is part of a long-term strategy for a long-term strategy to maintain your financial health.

You need AT LEAST annual or quarterly check-ups on even the best designed and implemented tax plans.

Many people work closely with their CPA initially on their tax plan but fail to continue to refocus on this as years progress.

Do you want help with the tax planning process?

Schedule a one-on-one consultation.

Yes, many tax strategies once initially set can be left alone and still yield a benefit.

But many strategies may need to be revisited, readjusted or even added to based on new facts and circumstances that require check-ins with your CPA.

Also, keep in mind, the tax code is constantly changing creating new opportunities and challenges for you as a taxpayer.

Just last week I saved a client $15,000 by identifying a new tax credit opportunity for them related to the passage of the CARES Act.

We put together the original tax plan for this client almost two years ago before the CARES Act was in place.

These are the type of tax planning opportunities that can go overlooked if you have a consistent focus on your tax plan.

Do you have a structured check-in process with your CPA?

👇 I recorded a video going over this below

Do you want us to help you with the tax planning process?

We cover the following aspects of your business and more during the tax planning process:

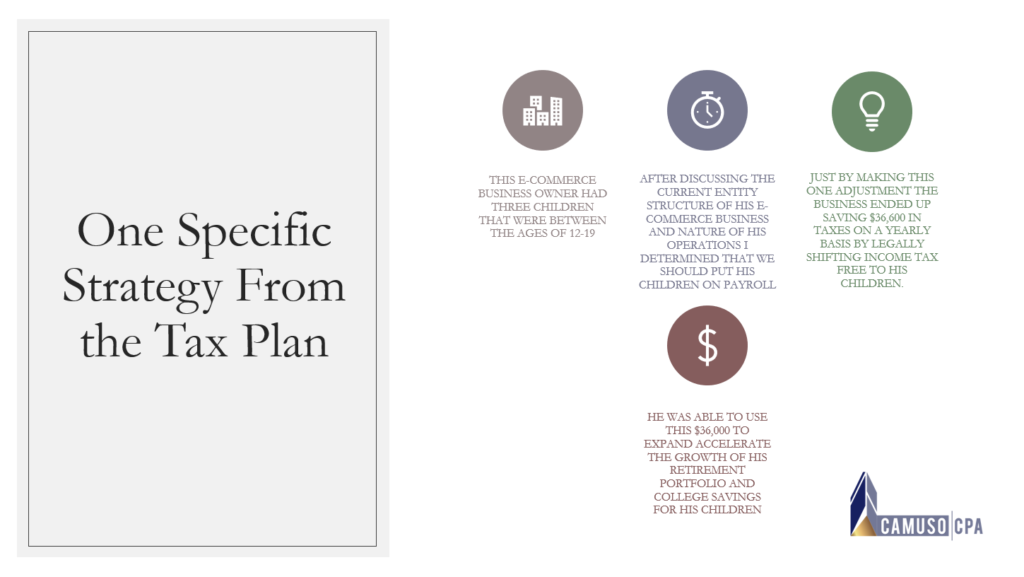

✔️ Legal Entity Structure

✔️ Accounting Method Optimization

✔️ Sales Tax and Other Compliance Assessments

✔️Deductions

✔️ Retirement

✔️ Insurance

✔️ Legal Tax Loopholes

✔️ Recent regulatory change

✔️ Niche specific strategies

✔️ Advanced planning strategies

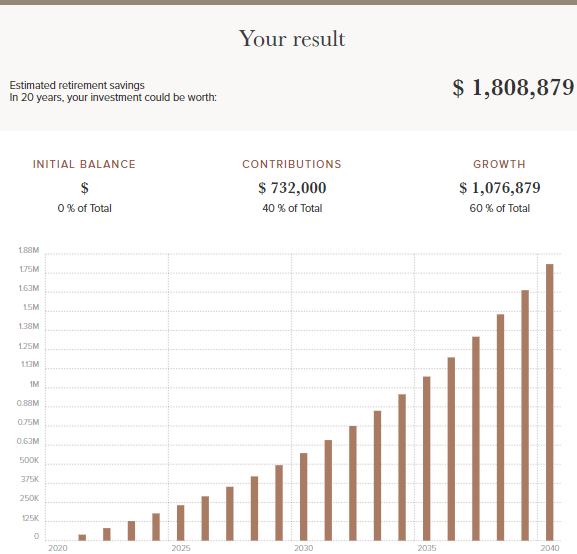

Strategies that put thousands of dollars back into your eCommerce business.