Tax planning is a systematic process.

It is about looking at the BIG PICTURE.

We use a proven approach to systematically assess your business and tax code to ensure we consider every opportunity available to reduce your taxes.

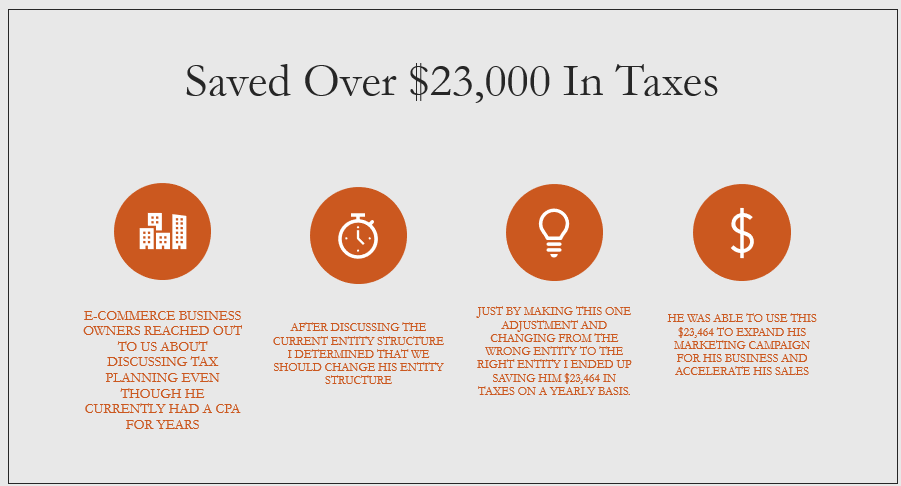

Like one client we recently worked with.

One specific legal entity structuring strategy from the Tax Plan that we delivered to this client produced a yearly tax savings of $23,000.

With this company, we upgraded their single member LLC into an S-Corporation.

Do you want help with the tax planning process for your eCommerce business?

Schedule a one-on-one consultation at the link below:

https://go.camusocpa.com/schedule-tax-planning-ss_ecommerce

We cover the following aspects of your business and more during the tax planning process:

✔️ Legal Entity Structure

✔️ Accounting Method Optimization

✔️ Sales Tax and Other Compliance Assessments

✔️Deductions

✔️ Retirement

✔️ Insurance

✔️ Legal Tax Loopholes

✔️ Recent regulatory change

✔️ Niche specific strategies

✔️ Advanced planning strategies

That means just after assessing step number 1 for this eCommerce business they will save $23,000 per year.

Does your CPA have a structured tax planning process?

If you are only speaking to your CPA once per year during tax season you are overpaying in taxes by TENs OF THOUSANDS of DOLLARS. YEARLY.

You need a proactive CPA with a proven tax planning system for eCommerce businesses.

Do you want us to help you with the tax planning process?

Schedule a one-on-one consultation at the link below:

https://go.camusocpa.com/schedule-tax-planning-ss_ecommerce

I went over this in detail in this video: