The general public believes that when they go get their taxes completed, their preparer has helped them organize their life to pay as little taxes as possible.

But that’s NOT true.

There is a HUGE difference between tax preparation AND tax planning.

If you have not taken the time to work with you CPA on a comprehensive tax plan you are leaving thousands on the table.

EVERY YEAR.

Schedule a one-on-one consultation at the link below:

https://go.camusocpa.com/schedule-tax-planning-ss_ecommerce

Just the other day, I delivered a tax plan to an eCommerce business owner.

After we implement the tax strategies, we outlined in our tax plan, the business will save $36,600 on taxes.

EVERY YEAR.

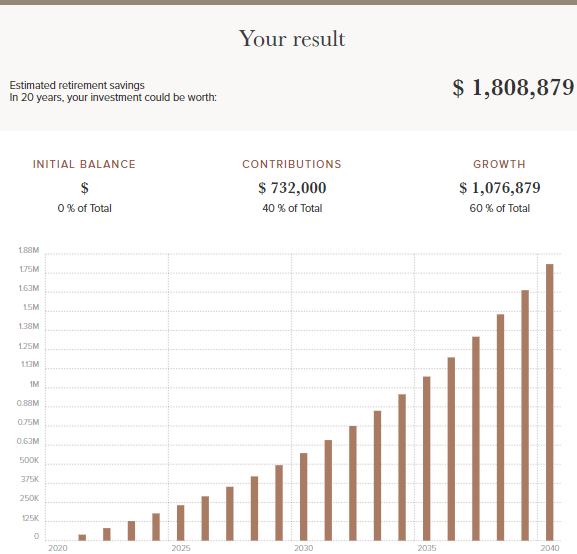

That yearly savings reinvested back into the business or market at only an 8% return will yield $1,808,879 over the next 20 years.

The owner had mixed feelings. He was very happy about the tax savings.

But also very angry.

This is because they have been overpaying in taxes for at least the last 4 years!

That means they overpaid their taxes by at least $146,400. Before opportunity costs considerations.

Ouch.

Schedule a one-on-one consultation at the link below:

https://go.camusocpa.com/schedule-tax-planning-ss_ecommerce

👇 I recorded a video going over this below

How often do you talk to your CPA?

If the answer is once per year during tax season, you likely are overpaying in taxes.

Tax preparation is focused on summarizing your historical information to accurately and timely file your tax return to remain in compliance with the IRS.

Tax Planning looks at your current operations and future projections to determine aspects of the tax code that can benefit your business and reduce your taxes.

Tax planning requires speaking with your CPA well before tax season and on a consistent basis.

The simplest way to put this is that tax preparation is a historical process but tax planning is a forward looking process focused on future tax savings.

We cover the following aspects of your business and more during the tax planning process:

✔️ Legal Entity Structure

✔️ Accounting Method Optimization

✔️ Sales Tax and Other Compliance Assessments

✔️Deductions

✔️ Retirement

✔️ Insurance

✔️ Legal Tax Loopholes

✔️ Recent regulatory change

✔️ Niche specific strategies

✔️ Advanced planning strategies

Do you want us to help you with the tax planning process?

Schedule a one-on-one consultation at the link below: